You might be curious about the differences between working as a wealth manager, and a financial adviser. This article will help you understand the benefits and cost differences of each. Working with a wealth manager can be a better choice when it comes to your financial affairs. Wealth managers offer a variety of financial services which may result in a higher fee. Wealth managers offer a range of services that include investing, estate planning and financial advisory.

Differences between a wealth advisor and a wealth manager

If you are concerned about your finances, you may be wondering what the differences are between a wealth manager and a financial planner. Wealth managers specialize in investment management. Financial planners, on the other hand, are holistic and can help clients with a wide range of financial topics. For example, a wealth manger will review your existing financial plan and recommend investments that suit your goals and tolerance for risk. A financial planner, on the contrary, may make recommendations for certain asset classes or securities.

A wealth manager is a type of financial planner that specializes in managing the assets of high-net-worth individuals. These people are usually involved in financial planning and investment strategies for individuals with less than $1 million in liquid assets. These assets do not include real estate holdings, durable goods, collectibles, and other valuable fixed assets. While wealth managers can generally manage any type asset portfolio, their main focus is on clients who have a lot of money.

Cost of working with a wealth manager vs a financial advisor

Private wealth managers typically charge more than financial advisors for their services. These fees can be hourly or annual and may also be project-based. Private wealth managers typically specialize in the services of high-networth individuals and their families, while financial advisers are available to all clients. Both types of professionals offer similar services so it's important that you understand the differences in the fees they charge.

Consider several things when comparing the costs of working with a wealth management firm to a financial adviser. You may not require a wealth management professional if your net-worth is not high. However, it may be beneficial for you. Wealth managers typically charge a percentage from your assets. This fee can vary among firms and accounts. In general, however, fees can start at one percent of your assets under management.

Benefits of working alongside a wealth manager instead of a financial adviser

While a wealth manager and a financial advisor offer similar services, their services differ greatly. Wealth managers can help you with more complex situations. They will also provide tailored advice to meet your needs. For example, a wealth manager will help you create a legacy plan, while a financial planner will focus on investments and asset management. Although both professionals have a lot of experience and are highly qualified, the benefits to working with a wealth manger are often more obvious.

A wealth manager will create an investment plan specifically tailored to the investor's objectives and risk tolerance. A wealth manager would receive 0.50% from a client with $10,000,000 in assets. It would lead to a $50,000 commission. However, a wealth manger would need to be able compete with the "whale client" for it. A wealth manager will typically charge a lower percentage depending on their assets and net worth.

FAQ

How old should I be to start wealth management

Wealth Management should be started when you are young enough that you can enjoy the fruits of it, but not too young that reality is lost.

The sooner you begin investing, the more money you'll make over the course of your life.

You may also want to consider starting early if you plan to have children.

Waiting until later in life can lead to you living off savings for the remainder of your life.

How to manage your wealth.

To achieve financial freedom, the first step is to get control of your finances. It is important to know how much money you have, how it costs and where it goes.

Also, you need to assess how much money you have saved for retirement, paid off debts and built an emergency fund.

If you don't do this, then you may end up spending all your savings on unplanned expenses such as unexpected medical bills and car repairs.

What are my options for retirement planning?

No. These services don't require you to pay anything. We offer free consultations, so that we can show what is possible and then you can decide whether you would like to pursue our services.

What are the benefits to wealth management?

Wealth management gives you access to financial services 24/7. Savings for the future don't have a time limit. It also makes sense if you want to save money for a rainy day.

There are many ways you can put your savings to work for your best interests.

You could invest your money in bonds or shares to make interest. Or you could buy property to increase your income.

If you decide to use a wealth manager, then you'll have someone else looking after your money. This will allow you to relax and not worry about your investments.

What is a financial planner? And how can they help you manage your wealth?

A financial planner can help you make a financial plan. They can analyze your financial situation, find areas of weakness, then suggest ways to improve.

Financial planners can help you make a sound financial plan. They can assist you in determining how much you need to save each week, which investments offer the highest returns, as well as whether it makes sense for you to borrow against your house equity.

Financial planners are usually paid a fee based on the amount of advice they provide. However, planners may offer services free of charge to clients who meet certain criteria.

Statistics

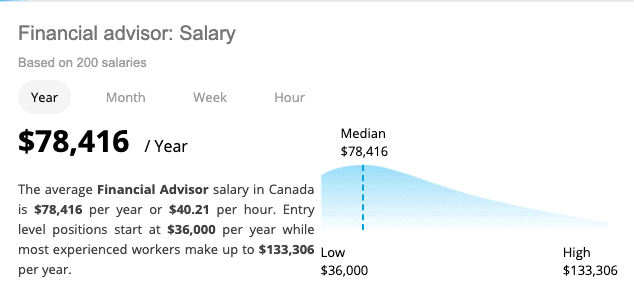

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

External Links

How To

How to Invest Your Savings to Make Money

You can generate capital returns by investing your savings in different investments, such as stocks, mutual funds and bonds, real estate, commodities and gold, or other assets. This is called investing. It is important to understand that investing does not guarantee a profit but rather increases the chances of earning profits. There are many options for how to invest your savings. These include stocks, mutual fund, gold, commodities, realestate, bonds, stocks, and ETFs (Exchange Traded Funds). We will discuss these methods below.

Stock Market

The stock market is one of the most popular ways to invest your savings because it allows you to buy shares of companies whose products and services you would otherwise purchase. Buying stocks also offers diversification which helps protect against financial loss. If oil prices drop dramatically, for example, you can either sell your shares or buy shares in another company.

Mutual Fund

A mutual funds is a fund that combines money from several individuals or institutions and invests in securities. They are professional managed pools of equity or debt securities, or hybrid securities. The mutual fund's investment objective is usually decided by its board.

Gold

The long-term value of gold has been demonstrated to be stable and it is often considered an economic safety net during times of uncertainty. It is also used in certain countries to make currency. Due to investors looking for protection from inflation, gold prices have increased significantly in recent years. The supply and demand factors determine how much gold is worth.

Real Estate

The land and buildings that make up real estate are called "real estate". When you buy realty, you become the owner of all rights associated with it. Rent out part of your home to generate additional income. You might use your home to secure loans. The home can also be used as collateral for loans. However, you must consider the following factors before purchasing any type of real estate: location, size, condition, age, etc.

Commodity

Commodities are raw materials, such as metals, grain, and agricultural goods. These commodities are worth more than commodity-related investments. Investors looking to capitalize on this trend need the ability to analyze charts and graphs to identify trends and determine which entry point is best for their portfolios.

Bonds

BONDS are loans between corporations and governments. A bond is a loan in which both the principal and interest are repaid at a specific date. As interest rates fall, bond prices increase and vice versa. Investors buy bonds to earn interest and then wait for the borrower repay the principal.

Stocks

STOCKS INVOLVE SHARES of ownership within a corporation. Shares represent a small fraction of ownership in businesses. You are a shareholder if you own 100 shares in XYZ Corp. and have the right to vote on any matters affecting the company. When the company is profitable, you will also be entitled to dividends. Dividends, which are cash distributions to shareholders, are cash dividends.

ETFs

An Exchange Traded Fund (ETF), is a security which tracks an index of stocks or bonds, currencies, commodities or other asset classes. ETFs can trade on public exchanges just like stock, unlike traditional mutual funds. The iShares Core S&P 500 eTF (NYSEARCA – SPY), for example, tracks the performance Standard & Poor’s 500 Index. This means that if SPY was purchased, your portfolio would reflect its performance.

Venture Capital

Ventures capital is private funding venture capitalists provide to help entrepreneurs start new businesses. Venture capitalists provide financing to startups with little or no revenue and a high risk of failure. Venture capitalists usually invest in early-stage companies such as those just beginning to get off the ground.