McKinsey has found that younger women retain their clients at a rate of up to one-third the revenue. In fact, firms who retain a larger percentage of younger women have four times the chance to grow their revenue than those that retain only older clients. The study also revealed that winning advisors with younger female clients see an average annual revenue growth of five per cent, which is more than the industry average by one percentage. However, these advisers are less experienced.

Female financial advisors can benefit from empowerment, collaboration, and work-life balance.

Focusing on work-life balance is one of the best ways for female financial advisors to be attracted. Eighty percent would prefer to work for a firm that supports a healthy work-life harmony, compared with 68 per cent who prefer firms without such perks. J.D. Power's recent survey confirms this fact. Power, who surveyed over 3200 advisors.

Despite the challenges women face, the industry is undergoing a change to address the issue. Many firms have been focusing on gender diversity in the workplace, including implementing work-from-home options. These changes will help women progress in their careers and their companies.

Women are more comfortable working with a female advisor in the financial services industry

Sometimes, a woman might prefer working with a female financial adviser because she is more at ease with the advisor's gender. But, great advisors can also come from men. Female advisors may not only be more comfortable but also more attentive to women's needs.

Most women want to know that their financial advisor is trustworthy. They also want to be confident in her moral guidance and knowledge. It's also essential to trust her to follow her fiduciary duty. After all, a financial advisor is responsible for your life savings.

Women also tend to think in terms of the big picture, and they have a high emotional quotient. These traits are crucial for successful financial planning. Financial planning can be a fulfilling career. It is especially attractive for women of color. U.S. News and World Report says that financial advisors are one of the best jobs in business and among the top 25 most highly paid jobs in America.

Females are more likely than men to change financial advisors

According to a recent study, women are more likely to switch financial advisors than men. These studies emphasize the importance for financial advisors to be able understand the unique needs that women investors. Financial goals and financial needs vary between women. Advisors who don't get it may not be able give high quality service. There are several solutions.

Women are more likely to change their financial advisors due to major life events. Divorce is one example of a significant life event that can have an impact on women’s finances. Divorced women are twice more likely to open new investment accounts than their male counterparts. Additionally, women feel more confident making financial decisions on their own.

FAQ

How important is it to manage your wealth?

Financial freedom starts with taking control of your money. Understanding how much you have and what it costs is key to financial freedom.

Also, you need to assess how much money you have saved for retirement, paid off debts and built an emergency fund.

This is a must if you want to avoid spending your savings on unplanned costs such as car repairs or unexpected medical bills.

What is estate planning?

Estate planning is the process of creating an estate plan that includes documents like wills, trusts and powers of attorney. These documents ensure that you will have control of your assets once you're gone.

What are the various types of investments that can be used for wealth building?

There are many investments available for wealth building. Here are some examples:

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its own advantages and disadvantages. Stocks and bonds, for example, are simple to understand and manage. However, they are subject to volatility and require active management. However, real property tends better to hold its value than other assets such mutual funds or gold.

It all comes down to finding something that works for you. The key to choosing the right investment is knowing your risk tolerance, how much income you require, and what your investment objectives are.

Once you have made your decision on the type of asset that you wish to invest in, it is time to talk to a wealth management professional or financial planner to help you choose the right one.

How old can I start wealth management

The best time to start Wealth Management is when you are young enough to enjoy the fruits of your labor but not too young to have lost touch with reality.

The sooner you begin investing, the more money you'll make over the course of your life.

If you want to have children, then it might be worth considering starting earlier.

You could find yourself living off savings for your whole life if it is too late in life.

Statistics

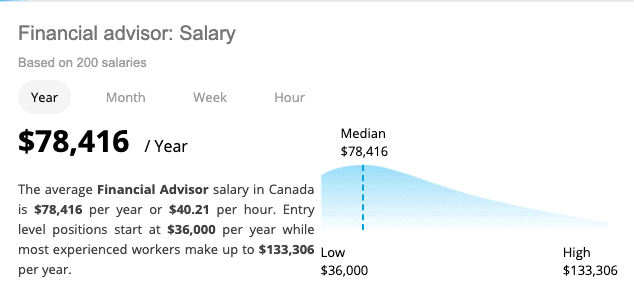

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

What to do when you are retiring?

People retire with enough money to live comfortably and not work when they are done. However, how can they invest it? There are many options. You could also sell your house to make a profit and buy shares in companies you believe will grow in value. You could also choose to take out life assurance and leave it to children or grandchildren.

If you want your retirement fund to last longer, you might consider investing in real estate. If you invest in property now, you could see a great return on your money later. Property prices tend to go up over time. You might also consider buying gold coins if you are concerned about inflation. They don’t lose value as other assets, so they are less likely fall in value when there is economic uncertainty.